Capital Structuring with Legal, Strategic & Investor Alignment

Structuring an investment round requires more than just funding needs — it requires strategy. At EIN Venture Capital (EINVC), we assist founders and CFOs in shaping fundraising rounds that meet legal, investor, and market expectations.

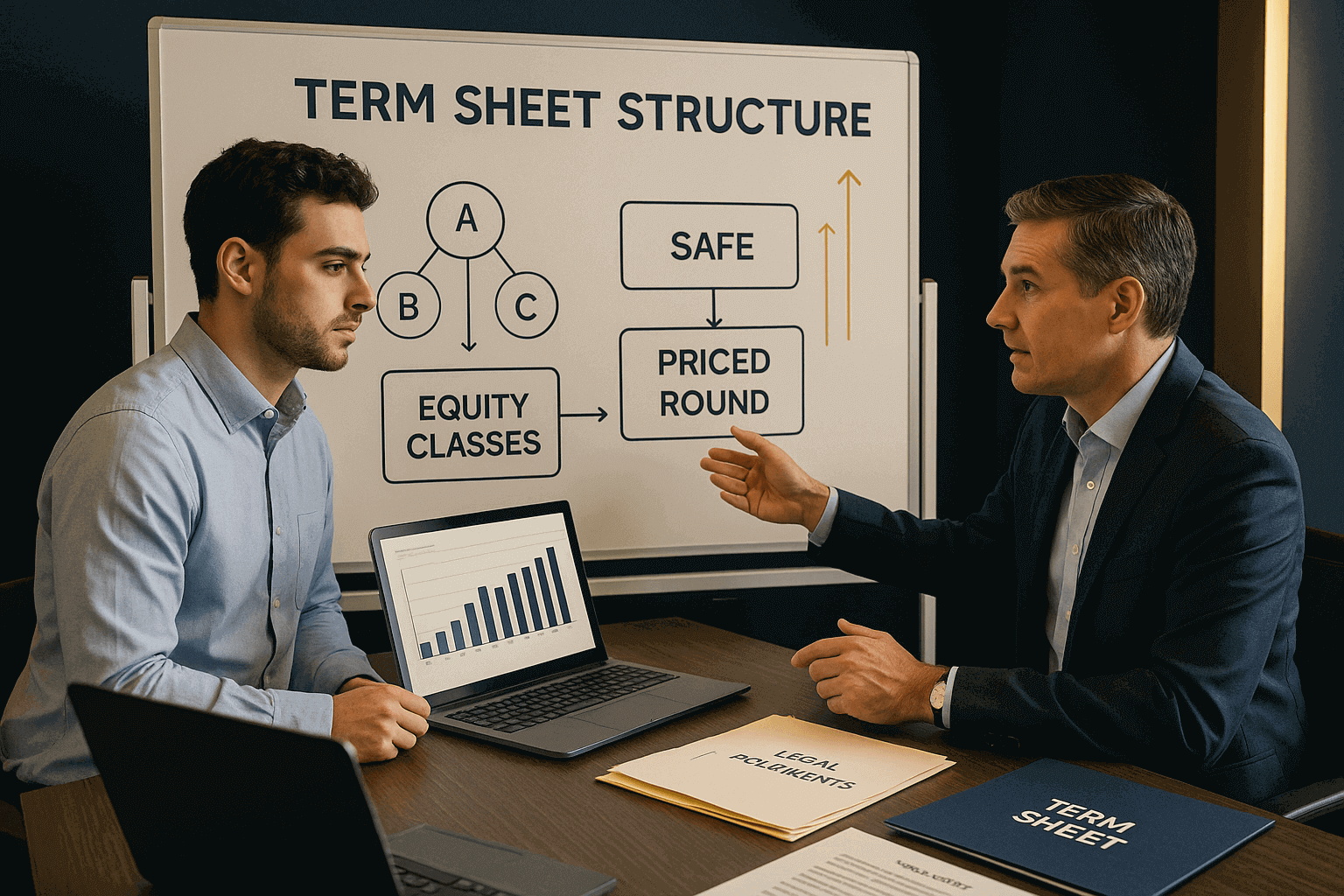

From investor onboarding to deal matching, we align capital structure with startup vision and long-term growth goals. Term sheets, equity classes, and dilution control are managed with clarity and compliance.

We support both founders and investors through SAFE, convertible notes, priced rounds, and custom hybrid structures, providing legal coordination, document review, and cap table advisory throughout the process.

Every round is a narrative — and EINVC ensures it's told through structure that protects value, aligns interests, and sets the deal up for closing.

We help businesses plan and structure their fundraising rounds with investor confidence, legal compliance, and strategic positioning. Raise capital with clarity.

Find CapitalMisaligned terms are the #1 reason deals collapse post-pitch. EINVC protects the close rate by aligning legal, financial, and strategic angles before investor presentation.

Our cross-functional team coordinates with legal counsel, funding teams, and Success Managers to guide you from fundraising theory to close-ready structure.

Whether you're raising funds or seeking investment-ready deals, EINVC helps connect you to the right capital at the right time.

Whether you're fundraising or investing in high-impact ventures, EINVC helps you act with clarity, speed, and strategy.