EINVC's Verified Access for Institutional & Private Investors

The Investor Network at EINVC is a carefully vetted circle of capital partners, angel investors, family offices, private equity firms, and institutional investors who are aligned with our mission of transparent, strategic deal-making.

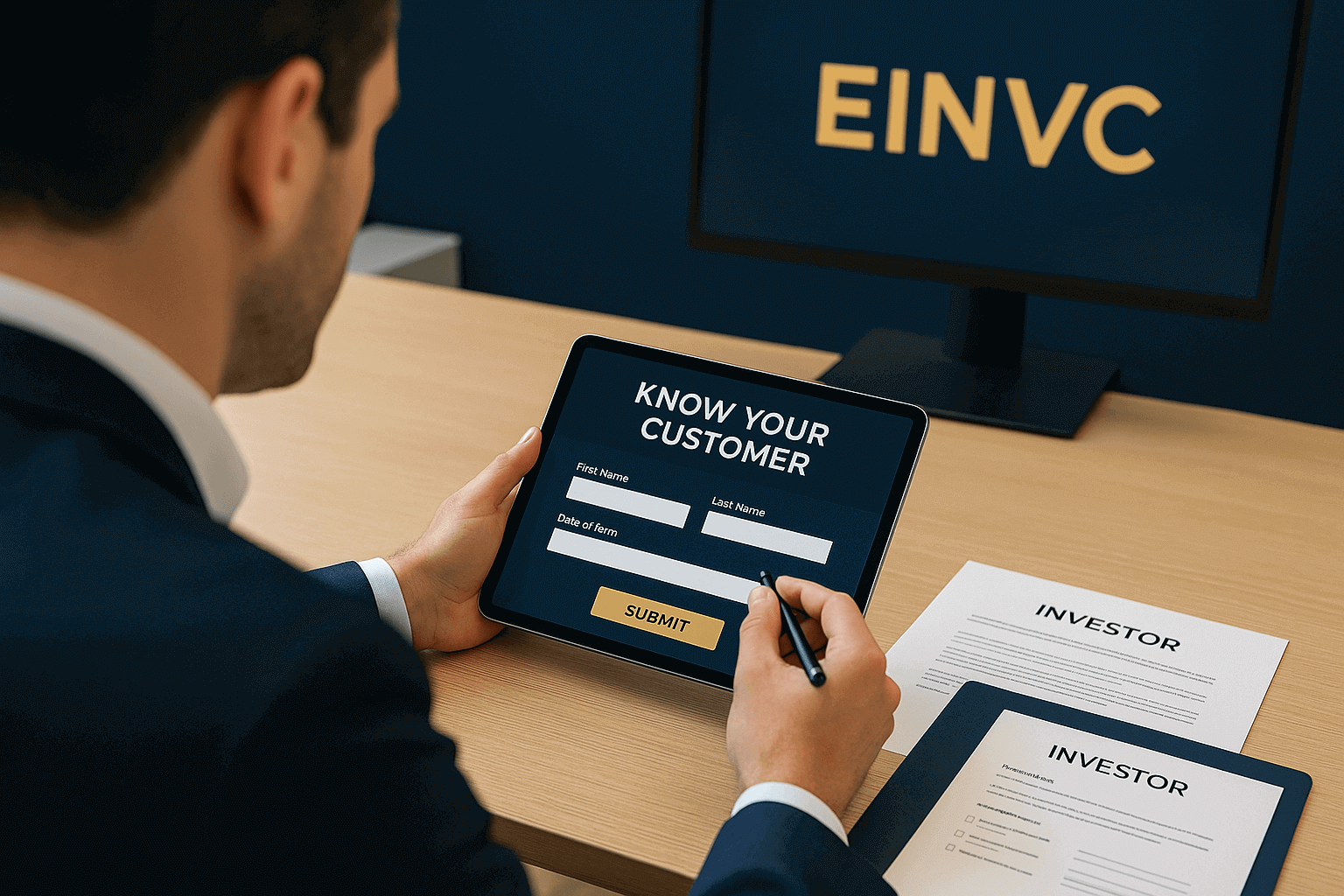

Admission is based on investor type, deal preference, capital commitment, and compliance verification. Our onboarding process ensures every member receives relevant, curated opportunities — and maintains platform integrity.

Become part of a capital community that values clarity, founder readiness, and legal compliance — not just pitch decks. EINVC is where investors connect with ventures that are built for execution, not just fundraising.

Get access to EINVC’s curated deal flow, founder data rooms, Success Managers, and capital compliance support.

Explore Active OpportunitiesInvestors complete a short application, go through eligibility checks, and receive a Success Manager briefing on how to use the platform.

Post-approval, you'll receive deal visibility tailored to your capital goals, investment stage, and sector preferences.

Whether you're raising funds or seeking investment-ready deals, EINVC helps connect you to the right capital at the right time.

Whether you're fundraising or investing in high-impact ventures, EINVC helps you act with clarity, speed, and strategy.